New MiCA Regulations Enhance Retail Investor Transparency

New MiCA Regulations Enhance Retail Investor Transparency

The European Securities and Markets Authority (ESMA), the EU’s financial markets overseer, has issued the second final report under the Markets in Crypto-Assets Regulation (MiCA). This report includes eight draft technical standards designed to boost transparency.

Targeted at retail investors, the second final report offers clear directives for service providers on disclosure, record-keeping, and data standards for oversight by National Competent Authorities (NCAs).

The key draft technical standards address sustainability indicators for crypto-asset consensus mechanisms and business continuity measures for crypto-asset service providers (CASPs). They also focus on trade transparency, detailing the content and format of orderbooks and record-keeping by CASPs.

Fund associations and industry experts analyze ESMA’s ESG fund naming guidelines

Moreover, the standards stress the necessity of both human and machine-readable formats for crypto-asset white papers and their registers. They outline requirements for public disclosure of inside information and specify how CASP trading platforms should publish data needed for pre- and post-trade transparency.

These draft standards aim to ensure NCAs have the information required for effective supervision of the EU crypto-asset market. This includes providing templates and formats for CASP order and transaction records to ensure transparency and accountability.

ESMA data strategy 2023-2028: A new era in financial data access and supervision

Public disclosures will enable investors to understand the environmental impacts of crypto-asset consensus mechanisms and guide issuers on disclosing price-sensitive information to prevent market abuses such as insider trading.

The draft technical standards will next be submitted to the European Commission for adoption. The Commission will make a decision within three months, marking a significant step towards improved transparency and regulatory clarity in the crypto-asset market.

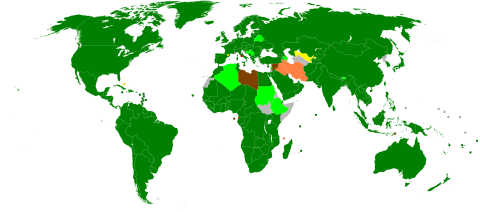

Photo attribution: Cflm001, World Trade Organization negotiations, CC BY-SA 3.0

Το comment on the article or to read all articles, please sign in or sign up